- December 23, 2025

- |

- News

Activate your growth with ChainThat's cloud-agnostic, SaaS-enabled platforms. Our intuitive and configurable technology enables your business to unlock its full potential.

Book a demoEmpowering (re)insurers, MGAs, and brokers with advanced technology, we streamline operations and drive innovation. ChainThat enables agile insurance organizations that meet evolving customer needs to stay ahead in the market.

Book a demoOur team brings decades of combined experience from within the insurance sector, coupled with cutting-edge technological expertise.

Book a demo

ChainThat's enterprise-grade, highly configurable insurance technology platforms – Beyond Policy Administration (BPA) and Beyond Multi-National Programs (BMNP) – activate agility and innovation in processes and operations, empowering your business to thrive in competitive spaces.

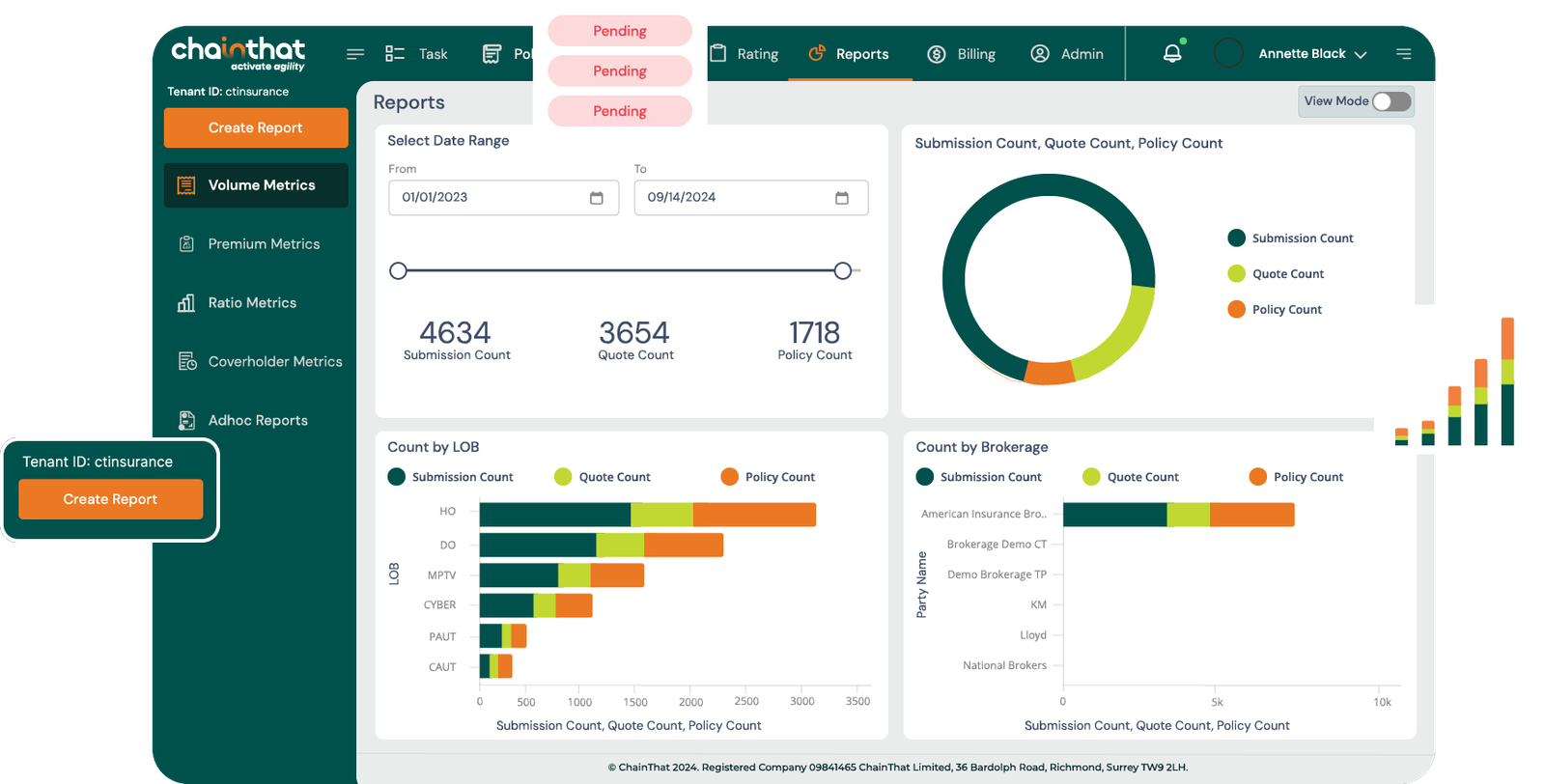

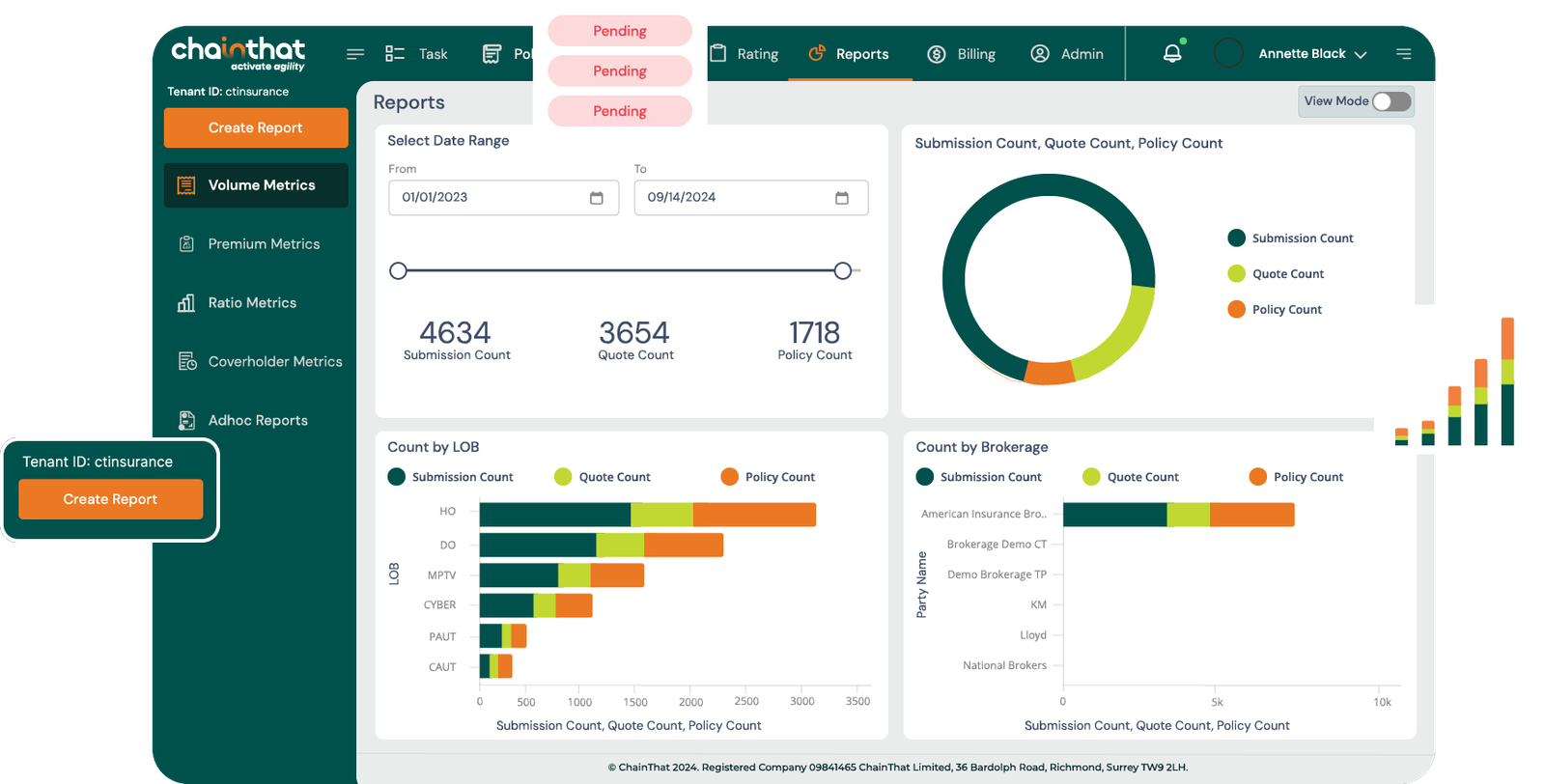

Beyond Policy Administration® (BPA) is the next-generation platform that provides end-end policy servicing and administration capabilities for insurers.

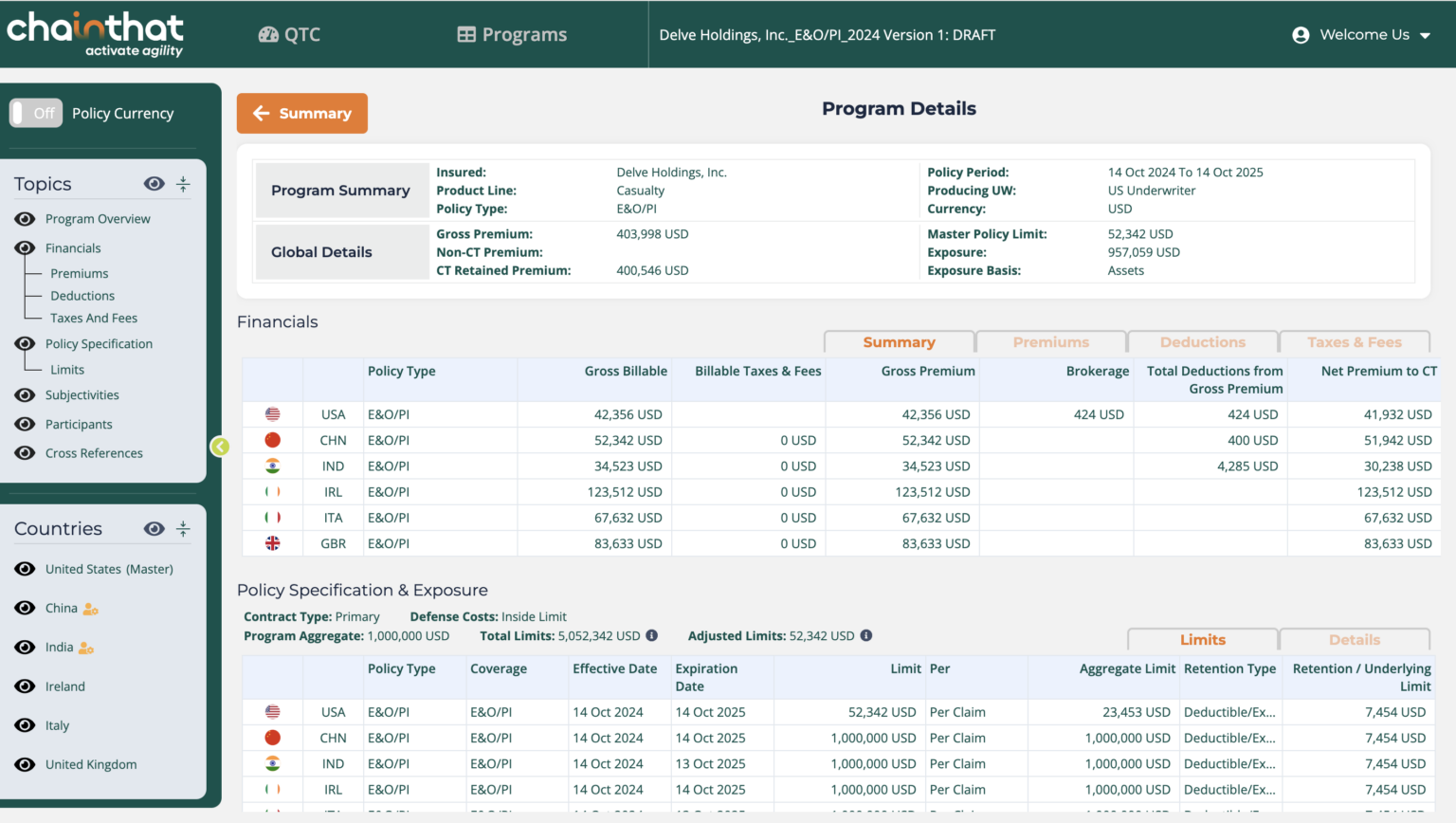

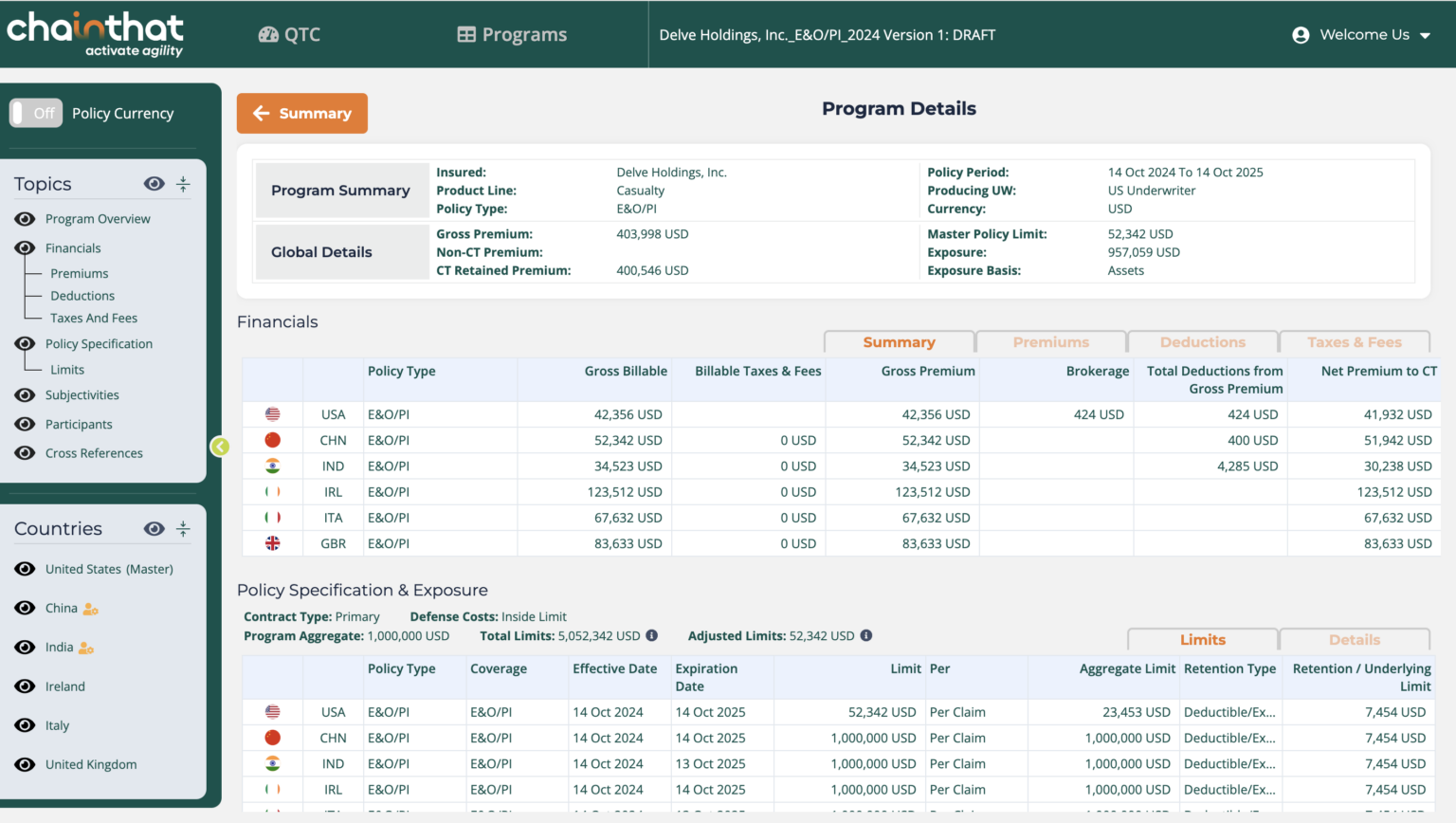

The digital co-ordination created for Insurers, for underwriting and processing complex multinational insurance programs.

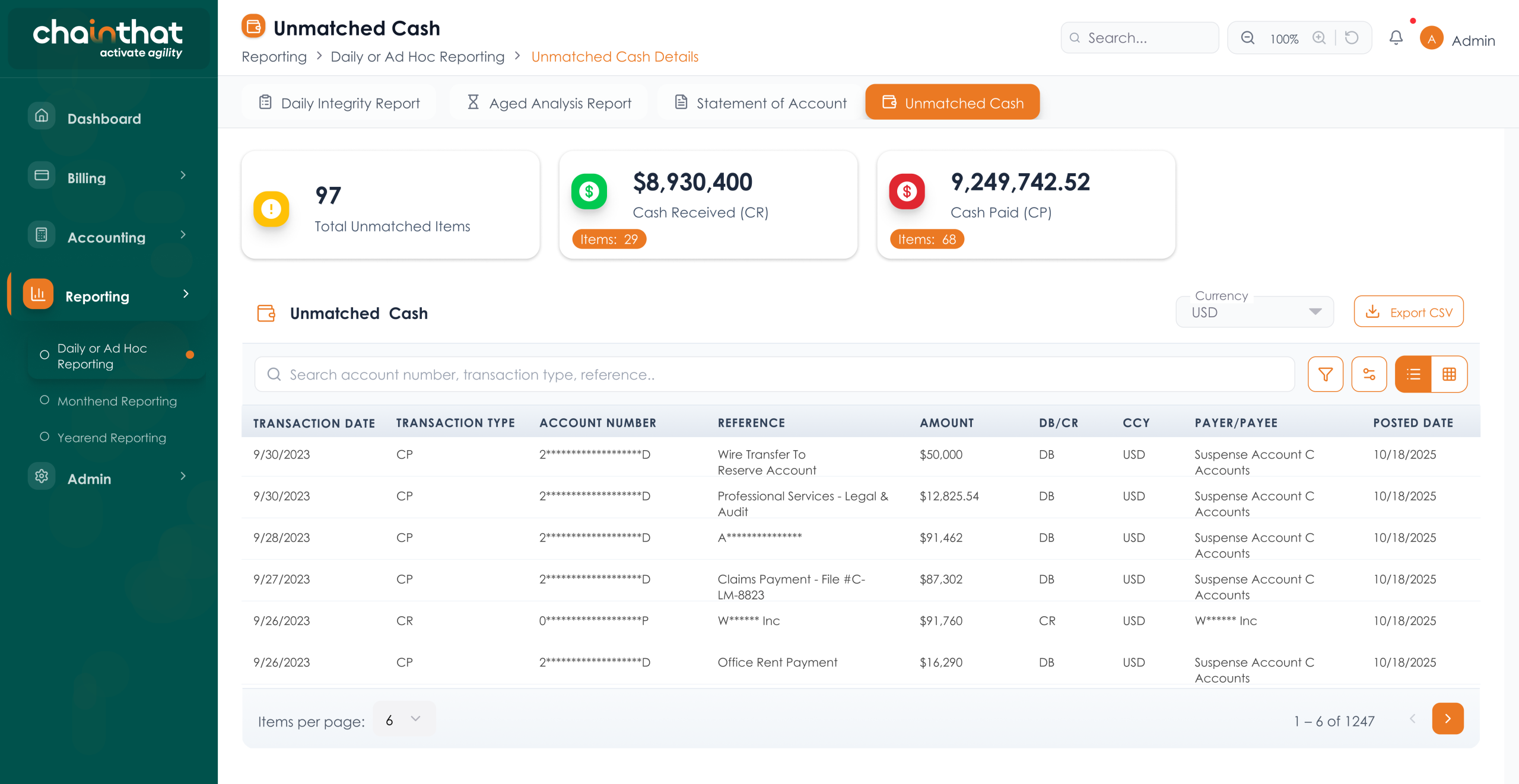

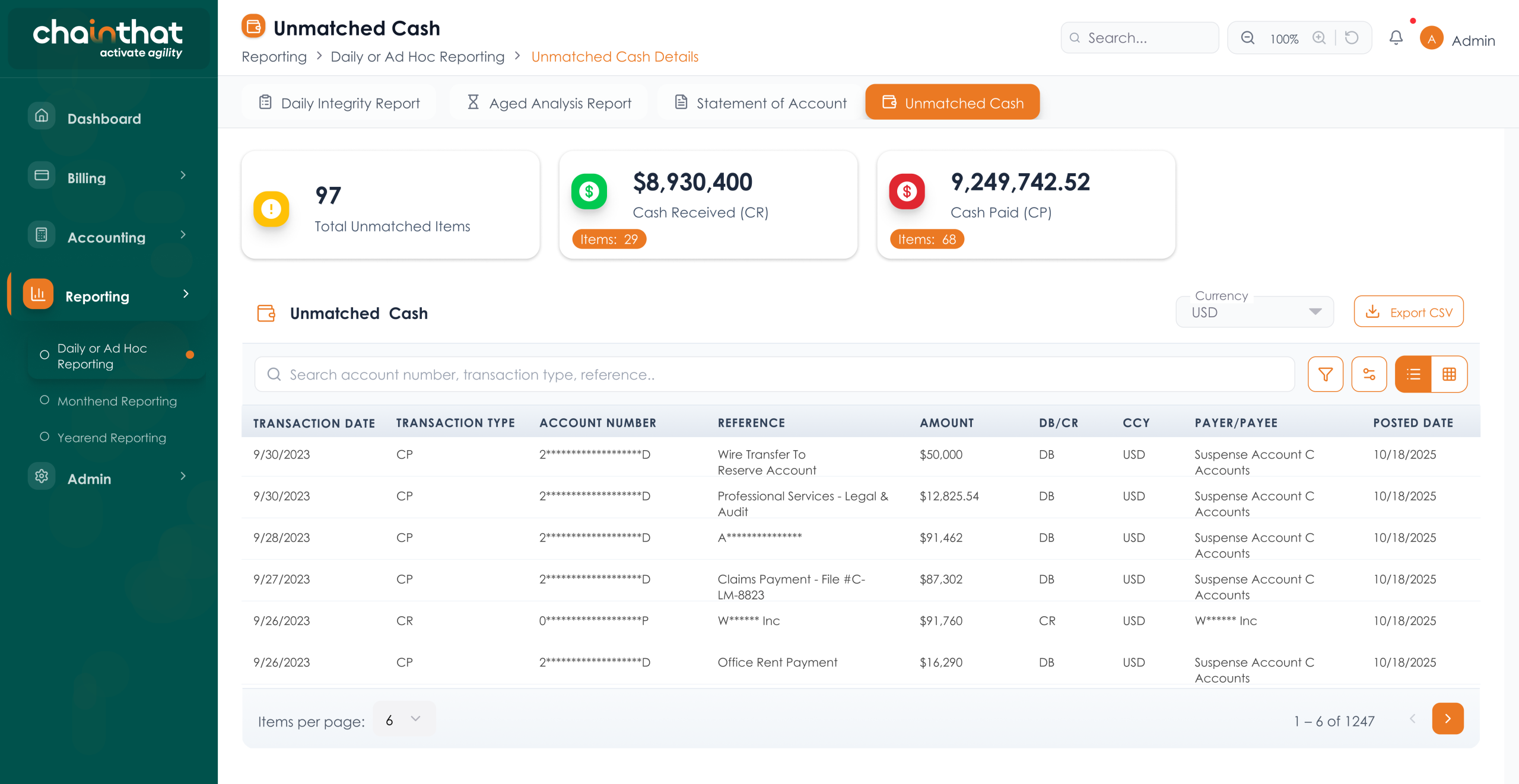

Beyond Insurance Accounting (BIA) is an industry-specific accounting platform that unifies billing, payments, and accounting into a compliant, automated solution.

Beyond Policy Administration® (BPA) is the next-generation platform that provides end-end policy servicing and administration capabilities for insurers.

The digital co-ordination created for Insurers, for underwriting and processing complex multinational insurance programs.

Beyond Insurance Accounting (BIA) is an industry-specific accounting platform that unifies billing, payments, and accounting into a compliant, automated solution.

Beyond Policy Administration® (BPA) is the next-generation platform that provides end-end policy servicing and administration capabilities for insurers.

The digital co-ordination created for Insurers, for underwriting and processing complex multinational insurance programs.

Beyond Insurance Accounting (BIA) is an industry-specific accounting platform that unifies billing, payments, and accounting into a compliant, automated solution.

founded

Continents with partners & customers

Of staff has direct insurance industry experience or specialized insurance training

Gross Written Premium Processed in the platforms

ChainThat’s platform empowers you to launch innovative products and explore new insurance models efficiently. Our industry-leading technology ensures your business stays ahead of the curve.

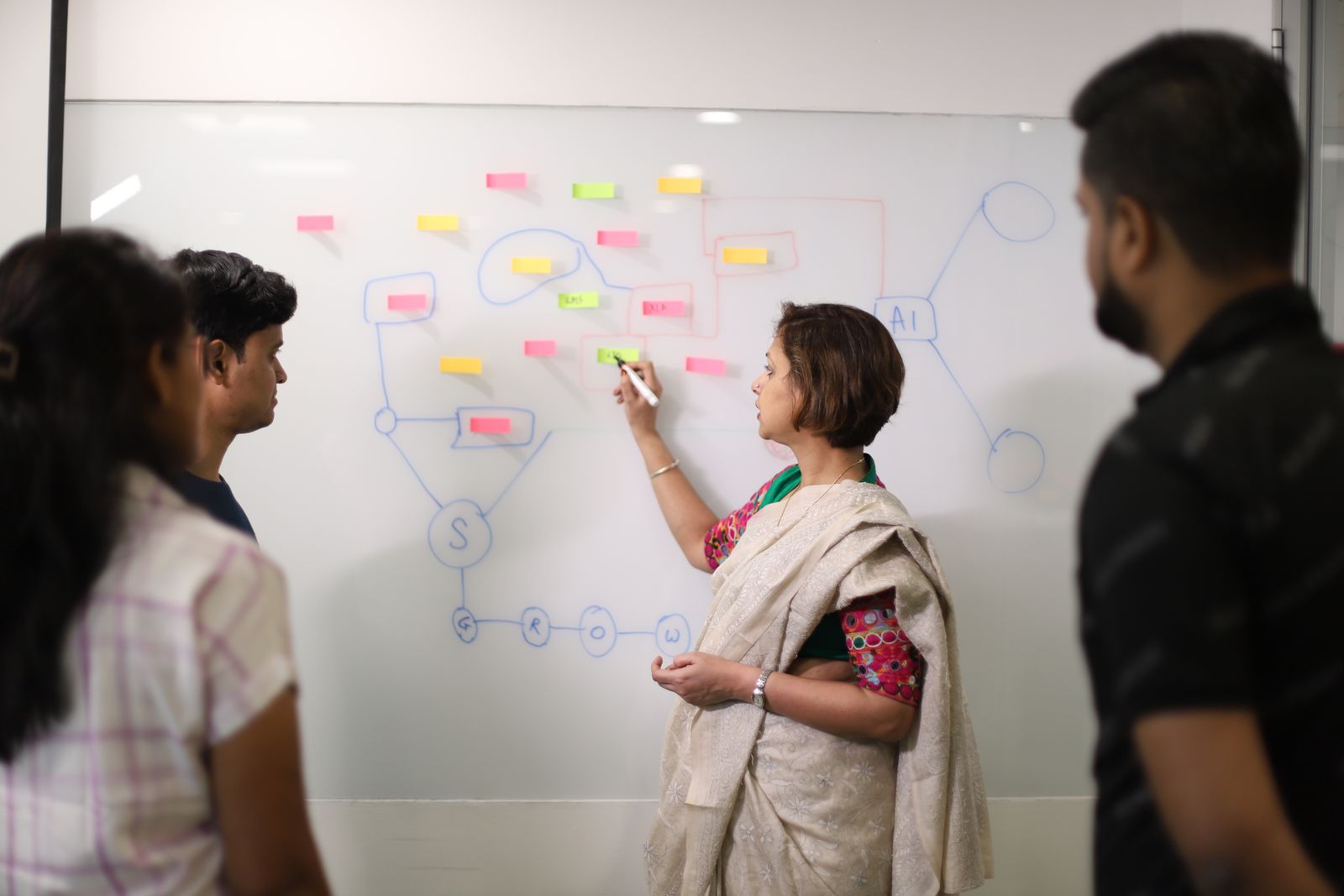

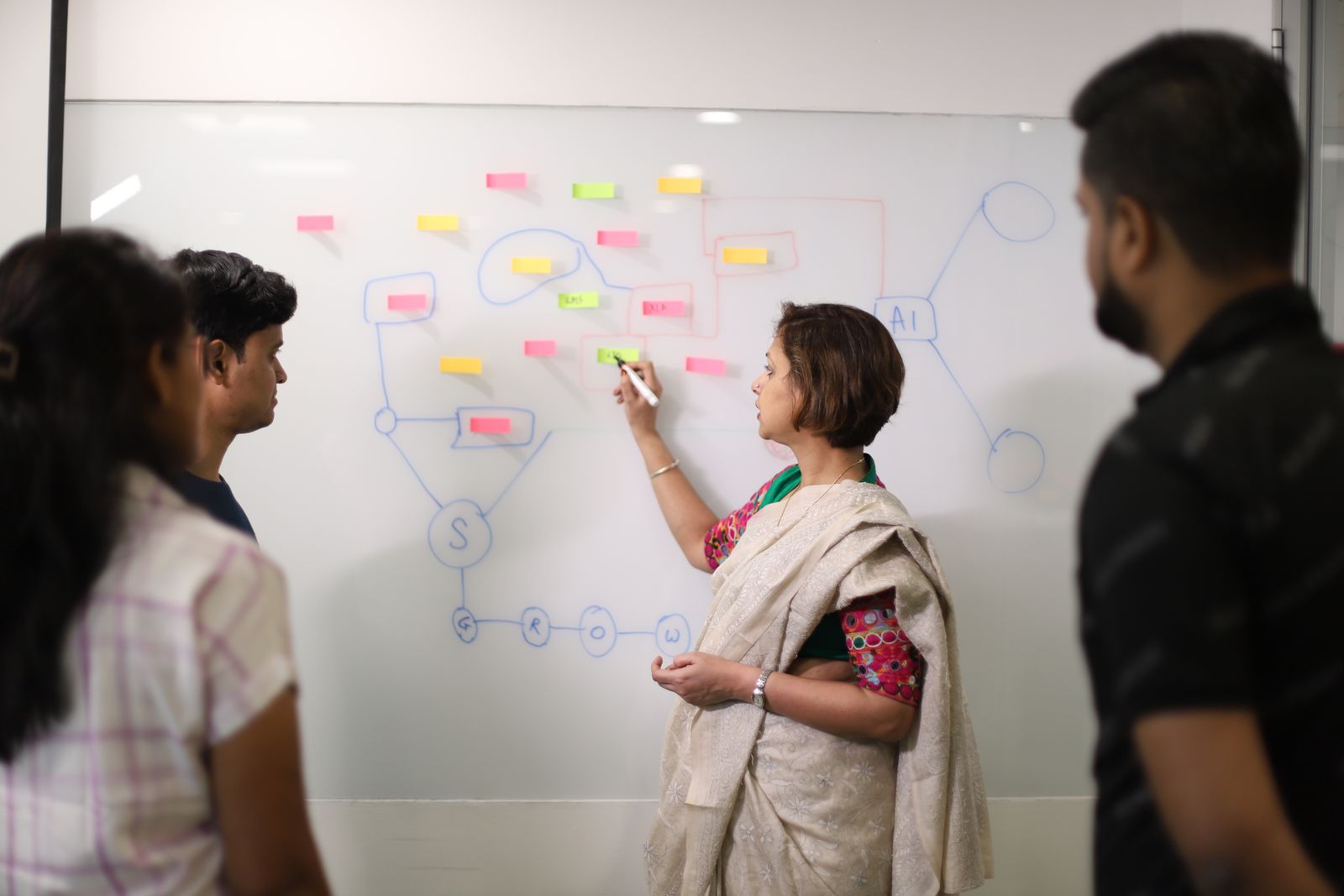

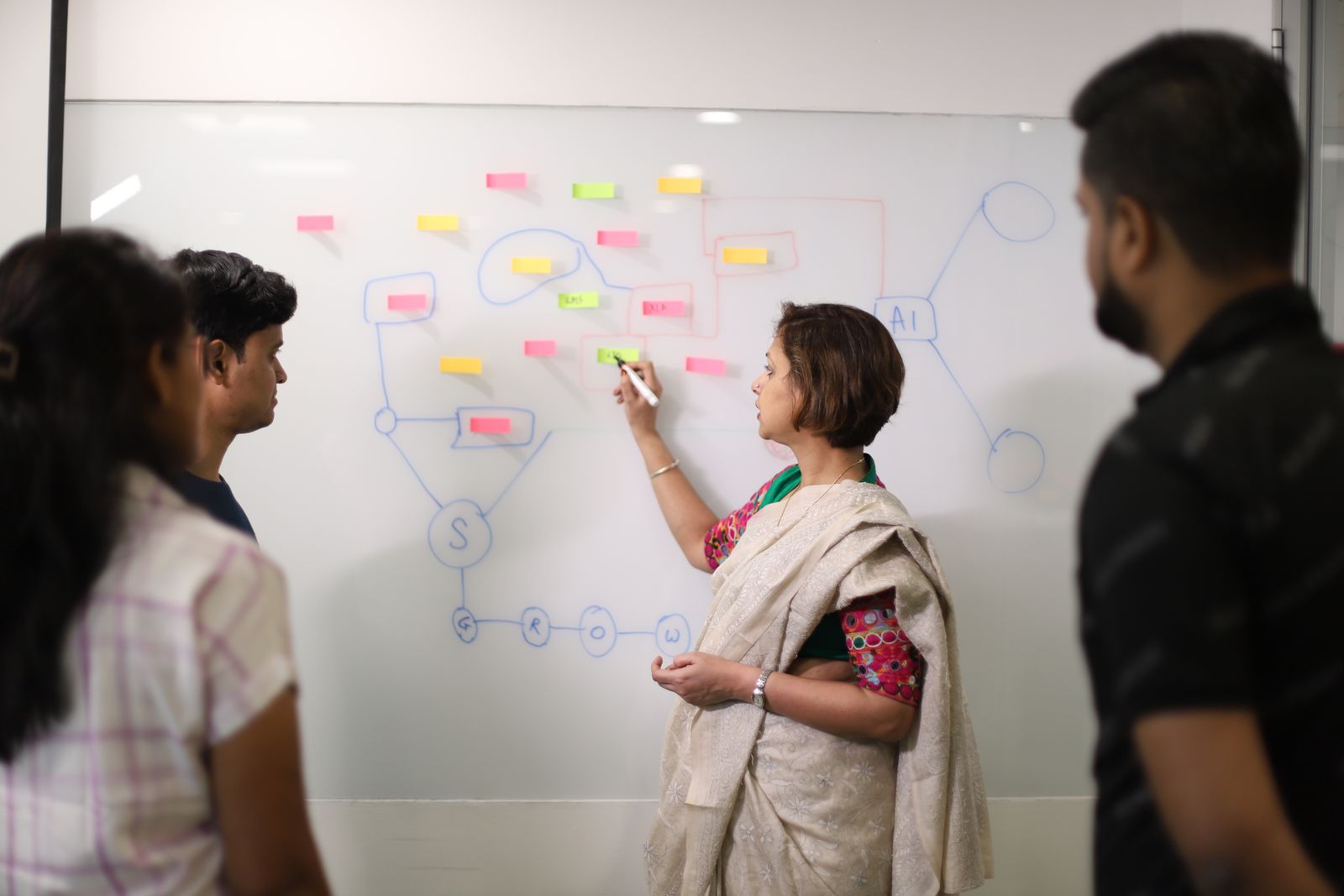

We bring valuable insights to the table. Our team combines this deep understanding of the insurance business with cutting-edge technology to support insurance organisation's throughout the value chain that allows them to meet their business goals.

Our modern SaaS platforms leverage cutting edge technologies to create a configurable system that provides seamless experience for insurers in managing their end-end policy lifecycle. Our API first approach with industry-leading security measures ensure effortless integration and scalable solution.

Working with ChainThat platforms enables insurers and MGAs to swiftly and efficiently bring new products to market. With streamlined processes and comprehensive support, you can reduce time-to-market, enhance flexibility, and ensure a seamless experience from product development to launch.

ChainThat embraces delivery agility, eschewing traditional-only approaches in favor of innovative, out-of-the-box thinking. Our fast-paced methodology supports business agility, allowing insurers to adapt swiftly to changing market demands. We prioritize flexible, iterative delivery that enable quick pivots and continuous improvements. Our commitment to delivery agility translates into tangible competitive advantages for our customers.

ChainThat's a cloud-native platform that improves market speed, customer satisfaction, and efficiency. Many insurers globally are benefiting, operationally and strategically, from such a platform. Let's hear it from our clients & partners.

“Enhancing operational efficiency and supporting scalable growth for an MGA that specializes in innovative cyber insurance products. Objectives included integrating advanced logic into workflows and enhancing process automation, reducing manual errors and facilitating seamless collaboration with a diverse range of partners.“. – Mike Cavanaugh, CUO of Fusion

“Our partnership with ChainThat is more than just a business agreement. It’s a commitment to continually innovate to deliver better products and a more efficient quoting experience for our brokers.” – Blair Nicholls founder and CEO of Clover

“Enhancing operational efficiency and supporting scalable growth for an MGA that specializes in innovative cyber insurance products. Objectives included integrating advanced logic into workflows and enhancing process automation, reducing manual errors and facilitating seamless collaboration with a diverse range of partners.“. – Mike Cavanaugh, CUO of Fusion

“Our partnership with ChainThat is more than just a business agreement. It’s a commitment to continually innovate to deliver better products and a more efficient quoting experience for our brokers.” – Blair Nicholls founder and CEO of Clover

“Enhancing operational efficiency and supporting scalable growth for an MGA that specializes in innovative cyber insurance products. Objectives included integrating advanced logic into workflows and enhancing process automation, reducing manual errors and facilitating seamless collaboration with a diverse range of partners.“. – Mike Cavanaugh, CUO of Fusion

“Our partnership with ChainThat is more than just a business agreement. It’s a commitment to continually innovate to deliver better products and a more efficient quoting experience for our brokers.” – Blair Nicholls founder and CEO of Clover

“With the ChainThat’s BPA platform, we can be in the driver's seat of our products & distribution channels, enabling us to grow quickly and enhance our solutions over time.”

"Our partnership with ChainThat is more than just a business agreement. It's a commitment to continually innovate to deliver better products and a more efficient quoting experience for our brokers."

"Amparo's mission has always been to provide fair and accessible auto insurance to the immigrant community. Partnering with ChainThat allows us to leverage advanced technology to better serve our customers...

"ChainThat's distributed ledger-centric platform supports consistency, compliance, and transparency in our multinational transactions, while delivering data clarity and protection across multinational accounts. It enables BHSI to seamlessly coordinate and collaborate...